The rates ARV for 2024 is 0.2891.

Commercial Rates

Increased Cost of Business (ICOB) Grant

As part of Budget 2024, the Government signed off on a package of €257m for the Increased Cost of Business (ICOB) Grant as a vital measure for small and medium businesses. Waterford City and County Council, funded through Department of Enterprise, Trade and Employment (DETE), will manage the rollout of the grant to qualifying businesses.

Increased Cost of Business (ICOB) Grant as a vital measure for small and medium businesses. Waterford City and County Council, funded through Department of Enterprise, Trade and Employment (DETE), will manage the rollout of the grant to qualifying businesses.

Eligible businesses will receive a once-off grant payment. The amount of the grant payable to eligible businesses is based on the value of the Commercial Rates bill the business received in 2023. However, it is not a Commercial Rates waiver and businesses should continue to pay their Commercial Rates bill as normal.

What is the purpose of the grant?

The grant is available to qualifying businesses as a contribution towards the rising costs faced by businesses. The grant is intended to aid businesses but is not intended to directly compensate for all increases in wages, or other costs, for every business.

How much is the grant?

The grant is based on the value of the Commercial Rates bill received by an eligible business in 2023.

– For qualifying businesses with a 2023 Commercial Rate bill of between €10,000 and €30,000, the ICOB grant will be €5,000.

– Businesses with a 2023 Commercial Rates bill greater than €30,000 are not eligible to receive an ICOB grant.

What businesses are eligible to receive the grant?

The following are the main qualifying criteria:

- Your business must be a commercially trading business currently operating from a property that is commercially rateable.

- Your business must have been trading on 1st February 2024 and you must intend to continue trading for at least three months from the date you verify your information.

- You must provide confirmation of your bank details.

- Your business must be rates compliant. Businesses in performing payment plans may be deemed to be compliant.

- Your business must be tax compliant and must possess a valid Tax Registration Number (TRN).

Please note that Waterford City and County Council reserves the right to claw back any grant payment which is later found to be incorrect. This includes any circumstances such as error by the recipient business or the local authority making the payment, or where a business makes a false declaration of eligibility.

How soon can businesses avail of the grant?

An online system has been developed to manage the submission of essential information. Waterford City and County Council has issued an invite letter to eligible businesses with further details, including how to register and how to submit information online. The system is now available, so please access your invite letter to apply.

What is the closing date?

The closing date for businesses to confirm eligibility and to upload verification details will be 1st May 2024.

Where can I find out further information?

Further correspondence and guidance has issued in mid March with the invite letter to commercially rateable businesses about the scheme. In addition, an FAQ is available below. You should refer to the invite letter for guidance and the FAQs below prior to making your submission.

If you have queries regarding your Commercial Rates account including outstanding balances, contact Waterford City and County Council at rates@waterfordcouncil.ie. Our team are happy to discuss any balances outstanding on your rates and what steps can be taken to ensure compliance with the scheme.

Download FAQs for Businesses Download ICOB User Guide

Why do we charge Commercial Rates?

Commercial Rates are a property-based source of income for local authorities. Rates are a statutory charge, the income from which is used to part-fund the annual revenue (day-to-day) expenditure of the local authority. Rates originated in the 19th century and are essentially a property tax on commercial premises.

There are currently three primary sources of local government financing which are universal amongst most countries. They are:

- Central Government; Grants

- Charges for Goods and Services and

- Commercial Rates

Commercial Rates is one of the primary sources of Local Government funding and the income from Commercial Rates underpins the entire range of services provided by local authorities. Commercial Rates are payable in equal moieties, the first on receipt of the demand, and the second on 1st July each year. Revenue Collectors have responsibility for the collection of Commercial Rates in Waterford City & County Council.

How are Commercial Rates calculated?

The Annual Rate on Valuation (ARV) is the figure used to calculate the annual Commercial Rates payable by the Occupier of a rateable property each year. This figure is determined by the elected members of the Council at the annual budget meeting each year, based on the deficit between Council income and expenditure for the forthcoming year. The rates ARV for 2024 is 0.2891.

The Annual Rate on Valuation figure is multiplied by the Valuation amount of the premises as determined by the Commissioner of Valuation.

For example: If your property has been valued at 20,000.00 by Tailte Éireann (formerly known as Valuation Office) then your Commercial Rates bill for 2023 will be: 20,000.00 X 0.2863 (ARV for 2023) = €5,726.00

Disclaimer: The Rates Calculation provided above gives you a sample rates liability for 2023.

How do I pay Commercial Rates?

The following payment methods are available:

Online

- By Credit Card or Debit Card, you can pay your Commercial Rates online. Your PIN appears on your Rate Demand. If you need a PIN reminder, please contact us on 058-21120.

- Electronic Transfer (EFT) To complete an Electronic Funds Transfer to Waterford City & County Council please use the following account details:

IBAN: IE71 AIBK 9340 7022 2960 86 BIC: AIBKIE2D Bank Name: Allied Irish Bank Plc, 3 TF Meagher Street, Dungarvan.

Direct Debit

By direct debit, monies are deducted on the 15th day of each month to clear liability by 31st December of the given year. Please note that as it takes a number of days to set up a direct debit, forms will need to be with Waterford City & County Council on the first day of the month to activate the direct debit during this month.

A Direct Debit Mandate form is available online here.

By Post or in Person

Cheque /Postal Orders: Payable to Waterford City & County Council by post to Commercial Rates Office, Waterford City & County Council, City Hall, The Mall, Waterford or Civic Offices, Dungarvan.

In Person: Payable in our Cash Offices in Civic Offices, Dungarvan or Bailey’s New Street, Waterford between the hours of 9.30am-4pm, Monday to Friday. Please quote your Account and LAID numbers. (Do NOT send cash in the post.)

By Phone: Please contact the cash office at 0818 10 20 20 with your card details between 9.30am-4pm, Monday to Friday, to arrange this type of payment.

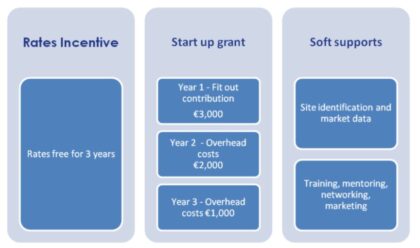

Economic Incentive Scheme for Vacant Properties in Urban Areas 2023-2024

Waterford City & County Council is offering incentives over a three year period to attract new retail and other businesses within the core retail area of the City Centre, towns and village centre of Waterford in order to bring vibrancy and vitality to the city and town centres.

It is intended to ensure that any incoming retail or service use will respect and enhance the multifaceted character of the area and will allow and encourage a diversity of uses to increase its overall attractiveness for shopping, leisure and business purposes.

There will be a strong presumption in favour of grant-aid for higher order comparison retail outlets including fashion outlets – both multiple and independent stores, ‘lifestyle stores’, flagship stores, niche and specialist retailers such as home furnishings, beauty products, jewellery and bookshops.

For further details, please see :

Current Grant Schemes

Commercial Rates FAQs

I have just opened a business. What rates do I pay ?

This depends on whether it’s a newly constructed property or an existing rated property.

Newly constructed premises will require to be valued by Tailte Éireann (formerly known as Valuation Office) before Rates become payable. Waterford City & County Council will list newly constructed premises for valuation. This involves an inspection of the premises by one of Tailte Éireann's qualified Valuers following which you will be notified of the proposed valuation. There is an appeal procedure should you wish to avail of it.

If you are taking over an existing rated property, then you will be liable for the existing Rates applicable to the premises. Extensive alterations will involve a revaluation. If you require information on the level of Rates applicable to that premises, you may contact the rates department for further information.

How to contact the Revenue Collector?

| Donal Fitzpatrick | 051-849964 or email dfitzpatrick@waterfordcouncil.ie (Waterford City) |

| Frank Walsh | 051-849965 or email fwalsh@waterfordcouncil.ie (Waterford City) |

| David Head | 051-849681 or email davidhead@waterfordcouncil.ie (Tramore, Dunmore East, Passage East) |

| Jennifer O’ Riordan | 058-22053 or email joriordan@waterfordcouncil.ie (Dungarvan, Cappoquin, Lismore, Tallow) |

| Susan O’Brien | 058-21437 or email sobrien@waterfordcouncil.ie (Dungarvan, Kilmacthomas, Portlaw, Bonmahon) |

I am leasing a premises, who pays the Rates? The Owner or Myself?

The Occupier of a premises is legally liable for payment of Rates on the premises.

What do I do if my property is vacant?

Rates are payable on vacant premises, however, an application may be made for vacancy relief if the premises is vacant and available for let, or alternatively it is vacant for the purpose of carrying out repairs or alterations.

| Vacancy Relief (vacant for a full calendar year) Vacancy relief has been available as follows: | |

| Prior to 2016: | 100% |

| 2016: | 80% |

| 2017-2019 | 55% |

| 2020: | 40% |

| 40% vacancy relief is the maximum rate allowable from 2020 onwards with the remaining 60% of the rates liability payable on the property. | |

- Partial Vacancy:

When a property is vacant for a partial year, relief is granted on a pro rata basis per month i.e. 1/12th of the annual vacancy relief applicable would be issued per month of vacancy.

- Eligibility & Conditions:

Application can be made online here or using a paper form (available at the end of the page. All relevant back up documentation must be submitted with the application.

All applications will be reviewed on an individual basis. Granting of relief will be contingent on adequate details being provided.

What happens if there is a Change of Occupant mid-year?

Owners of Commercial Properties are now obliged to notify the Local Authority, within 14 days of the transfer date, where there is a change in occupation of their property, i.e. when there is a change in tenancy or where a property is being sold, including where a property becomes vacant. The person transferring the property, either the owner or occupier are legally required to discharge all commercial rates for which he/she is liable at the date of transfer.

Owners must complete a Section 11 Form within 14 days of the change taking place. Owners who do not notify the local authority within 14 days will incur a financial penalty. This penalty is an amount equivalent to up to two years of outstanding rates from the previous occupier. Any penalty due and outstanding by an owner of relevant property due to non-notification will remain a charge on the property. The penalty charge is not affected by the subsequent payment of the outstanding rates and it remains payable even after the outstanding rates have been paid.

- See Section 11 form at the end of the page.

All ratepayers are reminded that they are legally required to pay all commercial rates due from them prior to their departure from a property or prior to the sale or transfer of an interest in a property. Any rates due and outstanding by an owner of relevant property will remain a charge on the property.

What can I do if I am unhappy with the rates I am paying for my property?

The valuation of a property is determined by the Commissioner of Valuation (Tailte Éireann (formerly known as the Valuation Office), Irish Life Centre, Abbey Street Lower, Dublin 1). No alteration can be made to the rates assessment of a ratepayer until such time as the valuation of a property is amended by the Commissioner of Valuation.

A ratepayer of the Council can seek to have the valuation on a property revised. For further details you can contact Tailte Éireann at 01 817 1000, email info@valoff.ie or log on to www.valoff.ie

What happens if I don’t pay my Rates?

Failure to pay your Rates by the specified period will result in legal proceedings being issued, followed by a Court Summons/Civil Proceedings. The Council may also register the debt as a judgement mortgage on a property.

What is a Set off on Account (contra-entry)?

A situation can arise whereby a Commercial Rates customer will also be a supplier of goods or services to Waterford City & County Council. Should a situation arise whereby Waterford City & County Council owes money to a Commercial Rates customer for goods supplied or services rendered and at the same time Commercial Rates are outstanding from that customer, the local authority reserves the right to apply a setoff (contra-entry) on account. This effectively allows for the payment of rates to be funded by way of amounts owing by the local authority to the rates customer. Section 58 of the Local Government Act 1941 facilitates this action.

What is Entry Year Property Levy?

The Entry Year Property Levy (PEL) is a charge which the local authority applies to newly erected or newly constructed properties pending the levying of commercial rates. It was introduced for the first time in 2008 under the Local Government (Business Improvement Districts) Act 2006, which was enacted on the 24th December 2006.

PEL is only charged in the year before the property becomes active in the Rate Book.

How is the Entry Year Property Levy Calculated?

The charge is calculated by reference to:

Rateable valuation on the property as determined by the Commissioner of Valuation.

- The annual rate on valuation (ARV) as determined by the Council.

- The date (entry date) the property is valued for rating purposes (i.e. entered in the valuation list).

- The number of days from the effective valuation date to the end of the yea